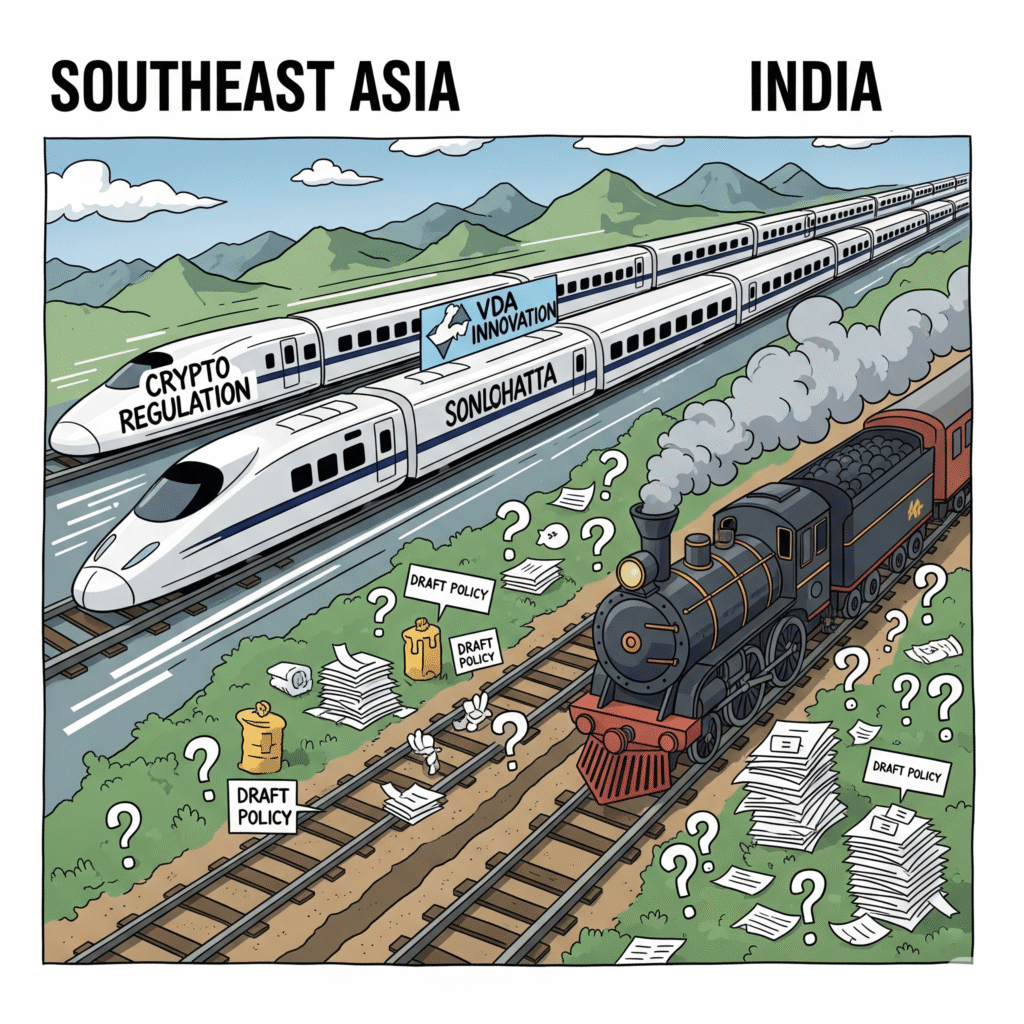

Southeast Asia’s Digital Asset Push Offers Lessons India Can’t Afford to Ignore

As Southeast Asian nations like Singapore, Thailand, and the Philippines roll out clear regulations and embrace digital asset innovation, India risks falling behind due to its fragmented policy stance. Experts...

As Southeast Asian nations like Singapore, Thailand, and the Philippines roll out clear regulations and embrace digital asset innovation, India risks falling behind due to its fragmented policy stance. Experts urge immediate action to establish a unified regulatory framework, ensure tax parity, and support responsible crypto growth before the gap widens further.

New Delhi: As Southeast Asia races ahead in embracing virtual digital assets (VDAs), India finds itself at a crossroads. Countries across the ASEAN region are laying down progressive regulatory frameworks, institutional infrastructure, and compliance mechanisms to support the fast-growing digital asset economy, leaving India at risk of falling behind.

From Singapore’s institutional focus to the Philippines’ retail-led surge, each Southeast Asian nation is carving its own niche in the digital finance ecosystem.

Singapore Sets the Institutional Tone

Leading the charge is Singapore, where the Monetary Authority of Singapore (MAS) continues to back digital innovation. A major step is the Singapore Exchange’s (SGX) upcoming launch of bitcoin perpetual futures in late 2025, targeted at institutional investors. This move signals a clear intent to integrate traditional finance with emerging crypto markets under a high-integrity framework.

Also read: Q4 Earnings Season in Full Swing: Key Companies Announce Results Today

Thailand and Vietnam Tighten Rules, Encourage Use

Thailand is strengthening investor protection. The Securities and Exchange Commission has mandated that exchanges hold customer assets in cold wallets—secure and auditable storage systems. The country is also looking to the future, permitting Bitcoin as a payment option for tourists and easing crypto taxation for a five-year window, offering incentives for trading on licensed platforms.

Vietnam is preparing a comprehensive legal framework to be rolled out by May 2025. While crypto remains illegal as a payment method, the country’s draft rules on ownership, money laundering, taxation, and licensing reflect an intent to formally recognize and regulate digital assets.

Indonesia and Philippines Push for Inclusive Finance

Indonesia is introducing OJK Regulation 3/2024, effective January 2025, which aims to create regulatory safeguards for financial institutions, including provisions for newer financial technologies like crypto. The focus is on risk-managed innovation.

The Philippines, meanwhile, continues to host one of the most dynamic crypto markets in the region. With over 18 million users and two million daily transactions, platforms like Coins.ph are leveraging youthful adoption and the remittance economy to foster inclusion through digital finance.

Institutional Interest on the Rise

The rise in institutional interest in the region is underscored by a recent partnership between crypto prime broker FalconX and Standard Chartered. Their collaboration seeks to enable regulated crypto services in Singapore, marking a significant shift toward mainstream institutional adoption.

Risks Prompt Calls for Stronger Oversight

However, rapid growth is not without its risks. The region recently came under the spotlight after the U.S. Financial Crimes Enforcement Network (FinCEN) flagged Cambodia-based Huione Group for laundering over $4 billion in crypto. Incidents like this highlight the urgent need for cross-border regulatory cooperation and robust anti-money laundering (AML) frameworks.

India at a Standstill Amid Regional Momentum

In contrast, India’s approach to VDAs remains largely reactive. While Southeast Asian nations are implementing forward-looking, coherent policies, India continues to navigate a maze of draft proposals and inter-departmental divergence. The absence of a central framework and clear direction threatens to isolate India from the global financial future taking shape.

Experts argue that a multi-ministerial committee is urgently needed to draft a cohesive policy. Tax parity between crypto and fiat transactions, clarity on investor protections, and a unified national stance on responsible innovation are critical to keeping India in the game.

The Clock Is Ticking

As global financial systems undergo a digital overhaul, India’s delay in engaging constructively with the VDA sector could come at a steep cost. Inaction is no longer an option. The experience of Southeast Asia offers a blueprint that India would do well to study, and adapt.

No Comments Yet