No Office, No Oversight: Why India Needs Stronger Crypto Platform Laws

Foreign crypto exchanges exploiting loopholes as government weighs tighter regulatory action 20th July 2025 , New Delhi As India steps up efforts to regulate its rapidly growing crypto economy, a...

Foreign crypto exchanges exploiting loopholes as government weighs tighter regulatory action

20th July 2025 , New Delhi

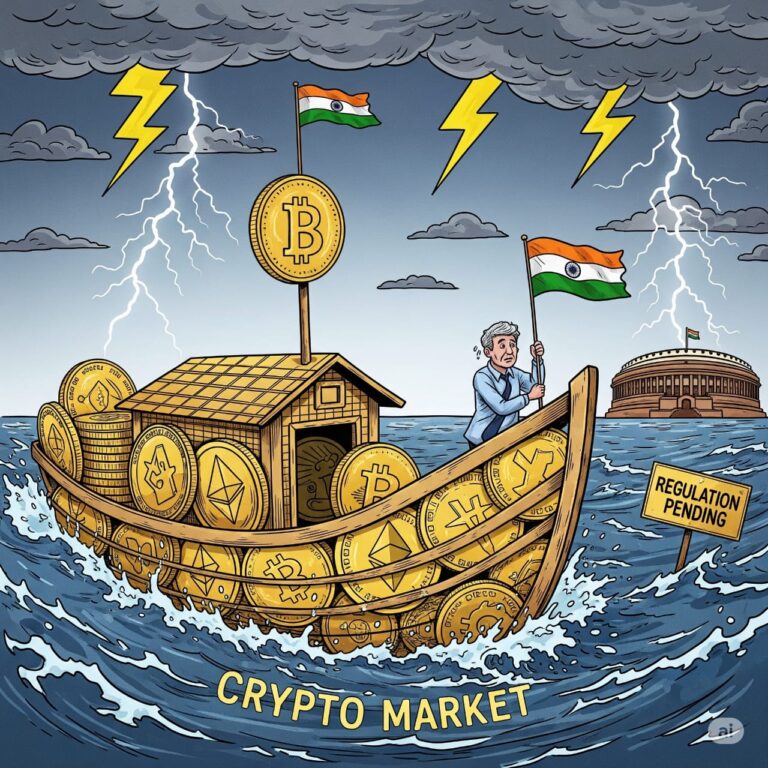

As India steps up efforts to regulate its rapidly growing crypto economy, a glaring gap in enforcement is threatening to derail the government’s otherwise significant progress: the absence of mandatory physical presence for offshore crypto platforms operating in the country.

In recent years, the Indian government has introduced several crucial policy measures — from including crypto platforms under the Prevention of Money Laundering Act (PMLA) to tightening reporting norms through amendments in the Income Tax Act. However, a large number of foreign crypto platforms continue to serve Indian users without establishing any physical or legal base within the country — exploiting a grey zone to avoid scrutiny, tax obligations, and regulatory compliance.

This regulatory evasion is not just about unfair competition between foreign and Indian platforms — it represents a serious threat to financial security, consumer protection, and national economic integrity.

These offshore firms, while targeting Indian consumers, are not registered with Indian regulators and do not employ personnel locally. Without a local presence, enforcement agencies lack the jurisdiction to hold them accountable — even if serious violations occur. In contrast, compliant Indian platforms are burdened with full-scale KYC, AML, and financial reporting requirements, creating a two-tiered market system — one transparent and responsible, the other opaque and risk-prone.

Such platforms offer services without any legal obligations to India, creating the perfect environment for capital flight, money laundering, tax evasion, and fraud. Even worse, they do not contribute to domestic job creation or capacity building.

This isn’t the first time India has faced such a challenge in the digital economy. In 2021, under the IT (Intermediary Guidelines and Digital Media Ethics Code) Rules, the government mandated that social media giants appoint local grievance officers and set up an India-based redressal system. Similar physical presence requirements already apply to telecom operators, payment companies, and digital broadcasters.

Given that crypto platforms deal with both financial assets and sensitive user data, the same — if not more stringent — standards must apply.

What India needs now is a clear legal mandate: if a crypto platform wants to serve Indian users, it must set up a registered entity with a physical office in the country. Several global economies, including the European Union, Japan, and South Korea, have implemented similar requirements for Virtual Asset Service Providers (VASPs) to safeguard their regulatory sovereignty.

Failing to act swiftly may not only cost India in lost tax revenues, but also risk the rise of a parallel digital economy operating beyond the government’s reach, endangering millions of Indian investors in the process.

No Comments Yet