CoinDCX Hack: $44 Million Liquidity Breach Raises Alarm, User Funds Remain Safe

Internal Liquidity Wallet Breached; $44M Routed via Solana and Ethereum, CoinDCX Pledges Full Compensation 20 July 2025, New Delhi In the aftermath of the $44 million digital heist that shook...

Internal Liquidity Wallet Breached; $44M Routed via Solana and Ethereum, CoinDCX Pledges Full Compensation

20 July 2025, New Delhi

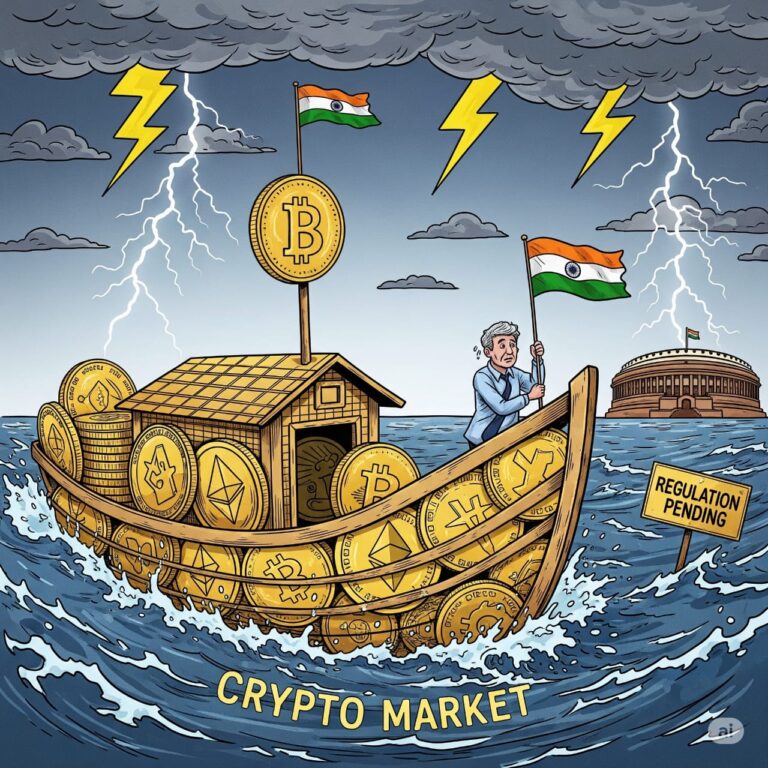

In the aftermath of the $44 million digital heist that shook one of India’s largest cryptocurrency exchanges, CoinDCX, the company has moved swiftly to contain the fallout and assure its users that no customer funds have been impacted. However, new revelations and unexplained silences are raising deeper questions about the attack’s origin, scope, and the broader implications for India’s digital asset ecosystem.

What Happened?

According to an official statement by CoinDCX, the breach occurred on July 19 at around 4:00 AM IST, when the company’s internal monitoring systems flagged suspicious activity involving an account used exclusively for liquidity provisioning. This account, which is part of CoinDCX’s operational infrastructure, was accessed without authorization via a partner exchange.

CoinDCX immediately launched an investigation and successfully isolated the affected systems, ensuring that the compromise did not extend to any customer-facing services or funds. Regular trading, INR deposits and withdrawals, and exchange operations have remained fully functional throughout.

Customer Assets Are Safe

CoinDCX was quick to reassure its user base that customer assets remain fully secure. These funds are stored in highly protected segregated cold wallets, completely separate from operational accounts.

Neeraj Khandelwal, Co-founder of CoinDCX, stated:

“We understand the gravity of the situation and want to reassure our users that their assets are completely safe. The loss is entirely on the company’s side, and we will absorb it through our own reserves. Our security protocols worked as intended to contain the breach swiftly.”

Tracing the Stolen Assets

Following the breach, CoinDCX initiated a forensic investigation in collaboration with two leading global cybersecurity firms and India’s CERT-In (Computer Emergency Response Team).

Initial findings show that approximately $44 million in USDT was routed through several chains and ended up in two main wallets:

- Wallet 1 (Solana): Holding ~$27.68 million

- Wallet 2 (Ethereum): Holding ~$16.28 million

Blockchain tracking revealed that the attackers converted assets using Solana’s Jupiter aggregator, bridged them via Wormhole, and then moved them into Ethereum. Some funds were originally sourced through Tornado Cash, a tool often associated with obfuscating transaction history.

Also Read: India’s Crypto Titan CoinDCX Hacked: $44 Million Vanishes in Coordinated Cyber Heist

Broader Implications for the Crypto Ecosystem

The breach adds to growing global concerns over crypto-related cyberattacks. In 2024 alone, hackers stole over $2.2 billion from crypto exchanges and DeFi platforms worldwide .

CoinDCX’s breach comes just a year after WazirX suffered a more severe hack, losing over $235 million, allegedly linked to a North Korean threat group. Experts caution that the increasing sophistication of attacks highlights the need for stronger cyber defenses across the sector.

The CoinDCX hack marks a serious moment for India’s crypto landscape. However, the exchange’s swift containment measures, transparent disclosures, and assurance to fully cover losses demonstrate a responsible and maturing approach to crisis management in the digital asset space.

Also Read: Sheila Dikshit Remembered on Death Anniversary for Shaping Modern Delhi

No Comments Yet