New Delhi, August 5 2025

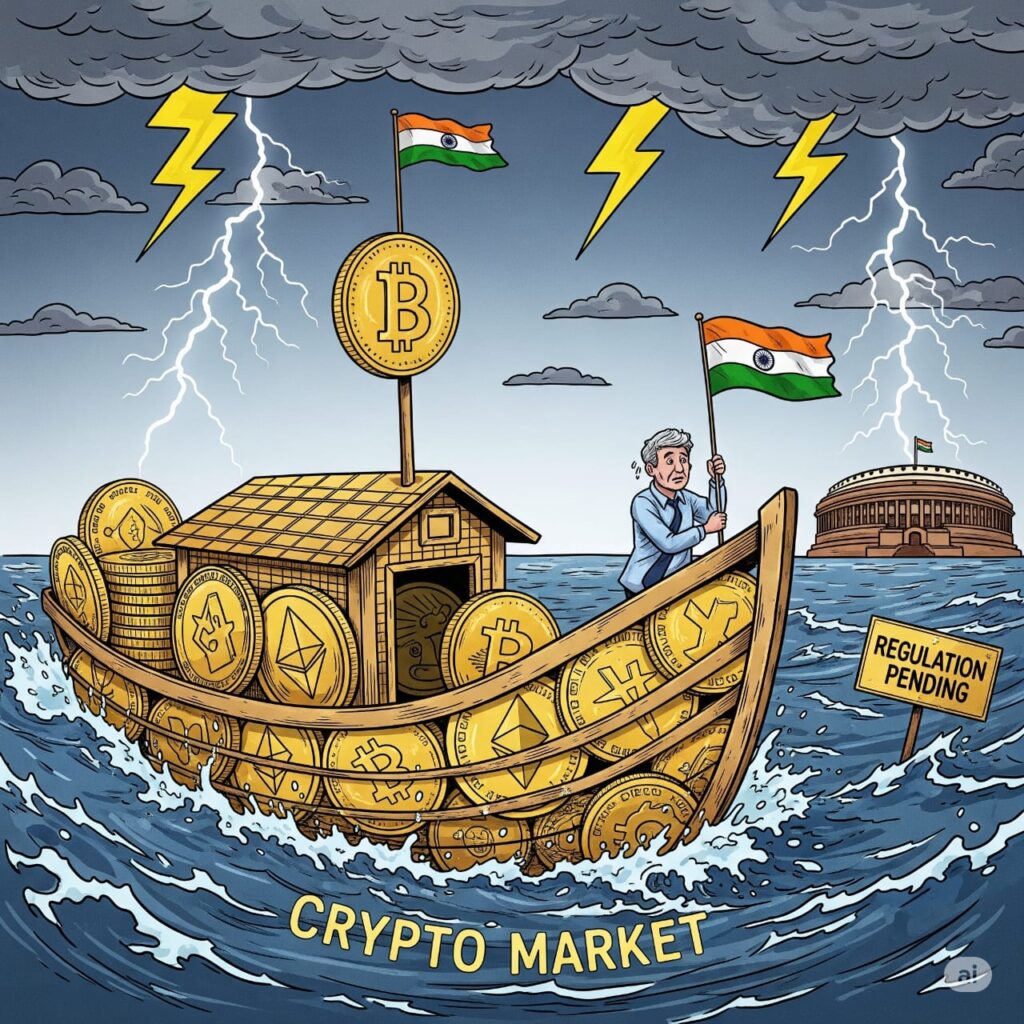

The Ministry of Finance responded to a question in the Lok Sabha on July 21, 2025, providing a rare insight into the government’s attempts to introduce taxes on income arising from Virtual Digital Assets (VDAs), including crypto assets. The response reported tax revenue from VDA income of ₹269.09 crore for FY 2022–23 and ₹437.43 crore for FY 2023–24, while the figures for the ongoing financial year are still being tallied. Although these increases are notable, the reported amounts likely reflect only a small fraction of the gains actually being made in the rapidly changing crypto ecosystem, as India is the biggest adopter of crypto, as cited by blockchain analytics companies. What this also indirectly demonstrates is the widening gap between the speed of digital innovation and the tools currently being used to regulate it—especially as just a day or two ago, media reports indicated that the Income Tax Department sent messages to thousands of people for apparently not paying the appropriate tax on crypto income.

Despite the introduction of Section 115BBH and TDS requirements under Section 194S of the Income Tax Act in Union Budget 2022, no official estimates have yet been made on how much tax revenue may be lost due to under-reporting of VDA income. This lack of projection or measurement suggests that the state is still flying blind to a significant extent. The government is relying heavily on information submitted by a few domestic exchanges to detect mismatches between declared income and VDA transactions. Through initiatives like the Non-Filer Monitoring System (NMS), Project Insight, and the “Nudge” campaign by the CBDT, taxpayers are being encouraged to revise returns where discrepancies are found. However, this is a largely reactive framework—one that detects non-compliance after it has already occurred, rather than preventing it in real time.

In some of the responses, the government also confirmed that there is no centralized system yet in place to match TDS filings by Virtual Asset Service Providers (VASPs) with the income tax returns of individual taxpayers. This gap makes enforcement inconsistent and weakens the intended deterrent effect of the tax provisions. In effect, India has visibility into VDA transactions but lacks the tools to exercise regulatory grip. Meanwhile, a large number of Indian users continue to transact on offshore crypto platforms that operate outside the purview of Indian law. These platforms often allow INR deposits through informal P2P networks and enable trading without KYC, making it difficult for Indian authorities to enforce TDS, AML-CFT obligations, or even basic investor protections.

The risks are not limited to investment platforms alone. As reported by Moneycontrol on July 30, 2025, offshore online gaming firms are now using crypto channels to launder winnings and evade tax obligations in India, compounding the problem of illicit crypto flows. These firms, operating outside India’s regulatory perimeter, often channel high-stakes gaming proceeds through wallets and exchanges that are difficult to trace—a tactic that tax officials say is becoming increasingly common. This underscores how crypto-based financial infrastructure is being used not just to avoid tax on capital gains, but also to facilitate unregulated cross-border transactions in sectors like gaming and betting, where the financial stakes—and the enforcement gaps—are both high. Earlier, a Delhi-based think tank had estimated that the government has already lost ₹6,000 crore in tax revenues and is likely to lose another ₹10,700 crore in the coming five years if the tax policy is not revised.

India can only enforce tax and compliance laws on VDA activity if there is a licensing regime that provides a legal basis to make foreign players adhere to Indian law. India will have to do more than just provide a surveillance toolkit and an awareness campaign if the current asymmetry is to be addressed. The Government of India knows best and must do more than merely monitor VDA activity. India must have a formal and regulatory structure that captures the entire VDA ecosystem—platforms such as exchanges, wallets, stablecoin issuers, and intermediaries operating in India or targeting Indian users. The primary purpose of this structure is to establish basic compliance mechanisms under state oversight. A legal framework should consider aspects such as mandatory registration and licensing for VDA platforms targeting Indian users, a checklist of tax-reporting obligations via a real-time API, a reporting mechanism with FIU-IND to enable enforcement of money laundering and terrorist financing investigations, and clarity on the legal categorisation of crypto assets—while also developing guidance for regulated investment into crypto assets that ensures the best possible investor protection.

Once such a legal framework is in place, the government can shift its approach to VDA monitoring from episodic detection to continuous supervision. It is commendable that the government is engaging in capacity-building initiatives for tax compliance officers, including training in blockchain forensics and data analysis in collaboration with institutions such as NFSU. However, it is critical that these initiatives are complemented by legal and regulatory clarity that leaves few loopholes for evasion.

To establish a credible environment for innovation and ensure the safety of its citizens and revenue base, India must make the shift away from post-facto policing to proactive governance. Taxation is only one part of the puzzle; regulation is the glue that holds it all together.